Orderbook trading course

5.Orderbook trading (2)

Hopefully you have been able to condition your eyes so that you can see how the orders are being carried out. It's not an easy process, as I said before, and the learning curve is steep. However, the reward will be there if you try your best.

So now to this exercise, which builds on the last exercise.

I want you to think again about what a large trader could do when executing an order. In theory, we said that if you execute a large number of contracts, you would probably do it slowly and try to disguise your activity.

What if there was another tool we could use to identify a place where a lot is likely to be bought and sold?

Our next tool - volume profile.

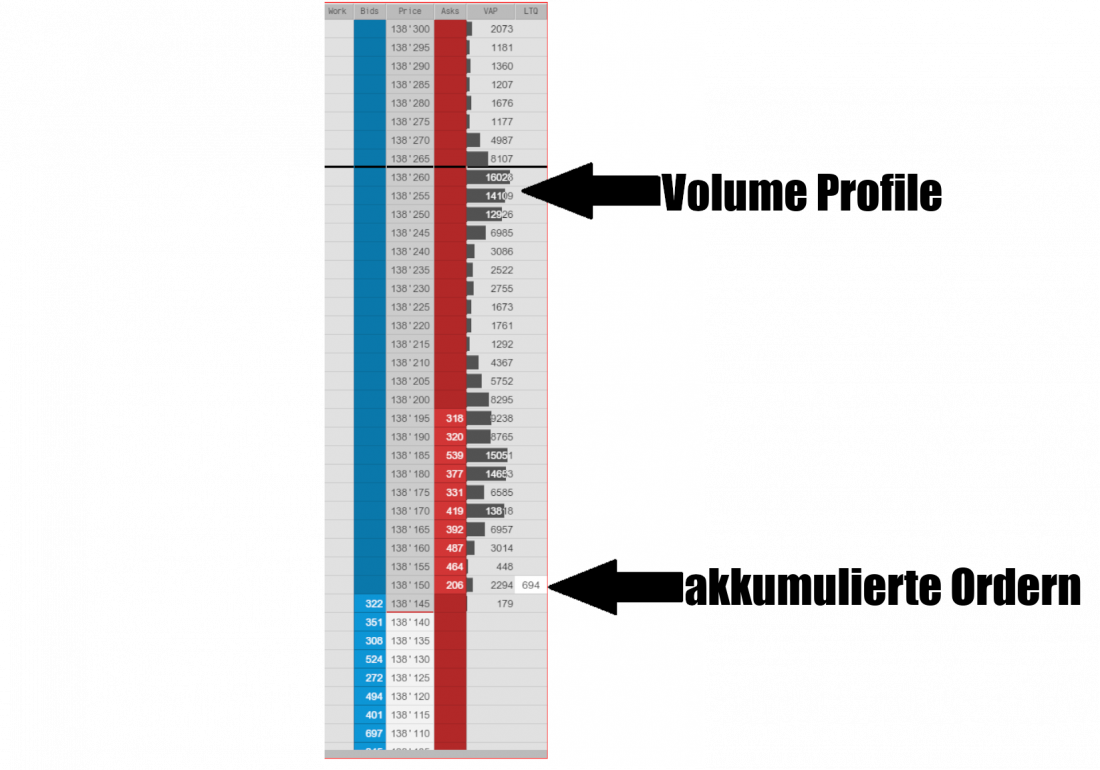

If you look at our picture, you will see the volume profile on the far right of the page. It shows the cumulative contracts that were traded in the current trading session. In the last exercise, we mainly focused on the contracts that were only recently traded. The volume profile is the sum of all these trades.

Why is it useful for us? Well, it shows us where there has been a large amount of buying and selling that has taken place at a certain level. And if there was previously a lot of volume at a certain price level, there is a chance that next time there will be a lot of activity when we return to that level.

But how do we identify these levels?

I like to look at areas that I call "Volume Profile Ledge".

A "ledge" simply means that there is a significant difference between two price levels. That is, only a small number of contracts were traded on one price and many contracts were traded on a price above or below.

You can either display the volume profile as a number in the order book or display it on a chart. Below you can see it once in a chart and in the order book.

As you can see, there is a significant difference in the chart in the contracts traded. The number of contracts is not so important here, much more that there is a significant difference between the two prices.

So imagine again what is going on here.

What we see is that every time the price has dropped back to that level, a buyer has come into the market and started buying.

Does that sound like a familiar concept?

For me, that's the definition of support. But I would say that drawing a line on a chart is a far more accurate idea of what a support is.

How can we use this support level, our “Volume Profile Ledge”, to improve our trading?

Well, we can use our skills (identify buyers and sellers), which we learned in our last exercise and can involve this with the Volume Profile.

Exercise

Look at the order book 2 hours a day. Use the market you used in the last exercise.

As the session progresses, the volume profile areas slowly begin to develop.

Search for price levels with significantly higher volume. Ideally, there is a ledge, but if there is no ledge, focus on the levels with the highest volume. If the price trades at these levels and 1-3 triple the bid or offer is traded, as we did in the first exercise, put yourself in the market with a limit order and try to get a fill.

Hold the trade as long as it works in your favor and end it when the 2-3 triple size of the bid or offer is in the opposite direction.

If the trade runs 3-4 ticks against you, exit the trade and look for further setups.

Bonus

If you feel more comfortable identifying the areas, write down how the price in certain areas starts to react.

- What happens when a ledge is close to the current high / low. What happens when it's far away?

- What happens if there is a volume ledge, but the price trades in a narrow range compared to a wide range?

- What happens if the price is traded on a high volume node?

- What happens if the price hits a volume ledge at the beginning of the session compared to later?

These are questions that you can ask yourself and that will be important in the future. You will quickly recognize patterns, so I recommend you take some notes in a notebook or with Word.

As always, if you have any questions feel free to write me on Discord.

I wish you success